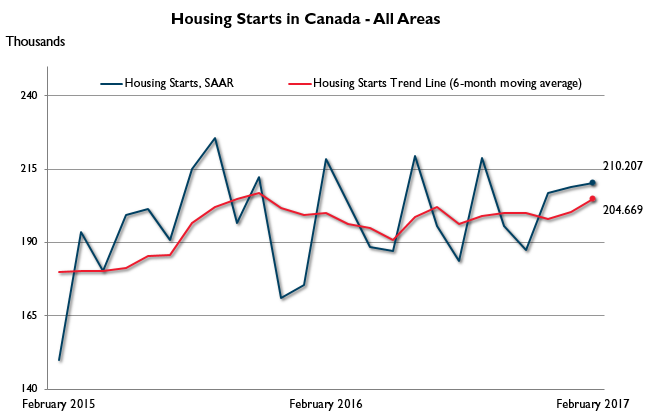

OTTAWA, March 8, 2017 — Housing starts are now on pace to hit 204,669 units in Canada, whereas January saw them hitting 200,255 units, according to Canada Mortgage and Housing Corporation (CMHC). This trend measure is a six-month moving average of the monthly seasonally adjusted annual rates (SAAR) of housing starts.

“This winter has seen Canada’s national housing starts trend upward, supported mostly by increased construction of homes in Ontario,” said Bob Dugan, CMHC Chief Economist. “New single-detached home construction in Ontario is reaching levels not seen in the province since July 2008 — offsetting recent slowdowns in British Columbia.”

Monthly highlights

- Condominium starts in the Montréal area increased considerably in February. The hike was mainly due to construction starting on some large real estate projects in the downtown Montréal-Griffintown sector. Activity on the new condominium market therefore remains strong in this zone, as these new units add to the nearly 3,000 units currently under construction.

- Sherbrooke has seen a rebound in single-detached housing starts in recent months. Lower supply on the resale market and a favourable job market have stimulated demand for new homes. In 2016, employment in Sherbrooke continued to grow, and the year ended with net gains in full-time jobs among people aged 25-44. These factors should support housing demand in 2017.

- In Toronto, low supply in the resale market resulted in demand spilling over into the new home market, particularly for low rise homes. Single-detached home starts were at their highest level for February in more than ten years. The total housing starts trend remained steady in February despite a drop in apartment starts.

- St. Catharines saw February 2017 housing starts reach the highest level for any February since 1991. A third of starts were townhouses and two-thirds were new singles across the region. This comes on the heels of a strong year for St. Catharines starts, where demand has been driven in large part by the relative affordability of housing compared to neighbouring markets.

- February saw total housing starts more than double in Winnipeg compared to the same period last year. New construction of multi-family units continued to drive total starts higher, with both purpose built rental and condominium units increasing year-over-year. Single-detached starts were also up by roughly 30% reflecting low inventories of completed and unsold new homes in 2016.

- Multi-family home construction more than doubled in Edmonton last month from the same period last year. This was unexpected given the near record levels of complete and unsold apartments on the market. The Edmonton apartment inventory has been high since the start of 2016.

- Housing starts in the Victoria CMA trended upwards in February. In particular, there was a surge in single-detached home starts in the West Shore municipalities. New construction has been supported by low inventories of homes for sale and strong migration to the region.

CMHC uses the trend measure as a complement to the monthly SAAR of housing starts to account for considerable swings in monthly estimates and obtain a more complete picture of Canada’s housing market. In some situations analyzing only SAAR data can be misleading, as they are largely driven by the multi-unit segment of the market which can vary significantly from one month to the next.

The standalone monthly SAAR of housing starts for all areas in Canada was 210,207 units in February, up from 208,934 units in January. The SAAR of urban starts increased by 0.9 per cent in February to 193,035 units. Multiple urban starts decreased by 4.7 per cent to 121,164 units in February, while single-detached urban starts increased by 12.1 per cent, to 71,871 units. Rural starts were estimated at a seasonally adjusted annual rate of 17,172 units.

Preliminary Housing Starts data is also available in English and French through our website and through CMHC’s Housing Market Information Portal. Our analysts are also available to provide further insight into their respective markets.

As Canada’s authority on housing, CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers objective housing research and information to Canadian governments, consumers and the housing industry.

For more information, follow us on Twitter, YouTube, LinkedIn and Facebook.

Original source https://www.cmhc-schl.gc.ca/en/corp/nero/nere/2017/2017-03-08-0816.cfm

Information on this release

CMHC media relations

National

Karine LeBlanc

CMHC Media Relations

613-740-5413

kjleblan@cmhc-schl.gc.ca

Quebec

Catherine Léger

514-283-7972

cléger@cmhc-schl.gc.ca

Prairies

Courtney Gillis

403-515-3012

cgillis@cmhc-schl.gc.ca

Atlantic

Katherine LeBlanc

902-426-6581

krleblan@cmhc-schl.gc.ca

Ontario

Angelina Ritacco

416-218-3320

aritacco@cmhc-schl.gc.ca

British Columbia

Jeanette Wilkinson

604-737-4007

jpwilkins@cmhc-schl.gc.ca

Additional data is available upon request.

| Area | Single-Detached | All Others | Total | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2016 | 2017 | year -over -year change (%) |

2016 | 2017 | year -over -year change (%) |

2016 | 2017 | year -over -year change (%) |

|

| Nfld.Lab. | 15 | 19 | 27 | 7 | 2 | -71 | 22 | 21 | -5 |

| P.E.I. | 1 | 5 | 400 | 0 | 8 | ## | 1 | 13 | ## |

| N.S. | 28 | 48 | 71 | 259 | 284 | 10 | 287 | 332 | 16 |

| N.B. | 13 | 9 | -31 | 3 | 4 | 33 | 16 | 13 | -19 |

| Atlantic | 57 | 81 | 42 | 269 | 298 | 11 | 326 | 379 | 16 |

| Que. | 179 | 238 | 33 | 1,647 | 1,903 | 16 | 1,826 | 2,141 | 17 |

| Ont. | 1,307 | 1,705 | 30 | 3,444 | 3,139 | -9 | 4,751 | 4,844 | 2 |

| Man. | 132 | 167 | 27 | 135 | 310 | 130 | 267 | 477 | 79 |

| Sask. | 143 | 120 | -16 | 110 | 168 | 53 | 253 | 288 | 14 |

| Alta. | 697 | 901 | 29 | 888 | 1,056 | 19 | 1,585 | 1,957 | 23 |

| Prairies | 972 | 1,188 | 22 | 1,133 | 1,534 | 35 | 2,105 | 2,722 | 29 |

| B.C. | 799 | 605 | -24 | 3,216 | 1,585 | -51 | 4,015 | 2,190 | -45 |

| Canada | 3,314 | 3,817 | 15 | 9,709 | 8,459 | -13 | 13,023 | 12,276 | -6 |

| Metropolitan Areas | |||||||||

| Abbotsford-Mission | 74 | 11 | -85 | 90 | 7 | -92 | 164 | 18 | -89 |

| Barrie | 13 | 40 | 208 | 17 | 139 | ## | 30 | 179 | 497 |

| Belleville | ** | 6 | ## | ** | 2 | ## | ** | 8 | ## |

| Brantford | 19 | 6 | -68 | 0 | 8 | ## | 19 | 14 | -26 |

| Calgary | 218 | 296 | 36 | 371 | 212 | -43 | 589 | 508 | -14 |

| Edmonton | 325 | 348 | 7 | 311 | 758 | 144 | 636 | 1,106 | 74 |

| Greater Sudbury | 0 | 0 | – | 0 | 0 | – | 0 | 0 | – |

| Guelph | 16 | 16 | – | 22 | 105 | 377 | 38 | 121 | 218 |

| Halifax | 14 | 35 | 150 | 257 | 267 | 4 | 271 | 302 | 11 |

| Hamilton | 30 | 70 | 133 | 164 | 277 | 69 | 194 | 347 | 79 |

| Kelowna | 49 | 68 | 39 | 262 | 154 | -41 | 311 | 222 | -29 |

| Kingston | 10 | 12 | 20 | 0 | 0 | – | 10 | 12 | 20 |

| Kitchener-Cambridge-Waterloo | 58 | 95 | 64 | 245 | 57 | -77 | 303 | 152 | -50 |

| Lethbridge | ** | 55 | ## | ** | 6 | ## | ** | 61 | ## |

| London | 72 | 120 | 67 | 24 | 93 | 288 | 96 | 213 | 122 |

| Moncton | 2 | 2 | – | 0 | 0 | – | 2 | 2 | – |

| Montréal | 75 | 123 | 64 | 1,039 | 1,528 | 47 | 1,114 | 1,651 | 48 |

| Oshawa | 26 | 115 | 342 | 50 | 19 | -62 | 76 | 134 | 76 |

| Ottawa-Gatineau | 62 | 141 | 127 | 306 | 546 | 78 | 368 | 687 | 87 |

| Gatineau | 8 | 15 | 88 | 162 | 90 | -44 | 170 | 105 | -38 |

| Ottawa | 54 | 126 | 133 | 144 | 456 | 217 | 198 | 582 | 194 |

| Peterborough | 7 | 6 | -14 | 0 | 0 | – | 7 | 6 | -14 |

| Québec | 27 | 29 | 7 | 234 | 81 | -65 | 261 | 110 | -58 |

| Regina | 42 | 43 | 2 | 60 | 131 | 118 | 102 | 174 | 71 |

| Saguenay | 3 | 3 | – | 10 | 2 | -80 | 13 | 5 | -62 |

| St. Catharines-Niagara | 66 | 86 | 30 | 31 | 54 | 74 | 97 | 140 | 44 |

| Saint John | 3 | 2 | -33 | 0 | 0 | – | 3 | 2 | -33 |

| St. John’s | 12 | 16 | 33 | 6 | 0 | -100 | 18 | 16 | -11 |

| Saskatoon | 91 | 68 | -25 | 42 | 20 | -52 | 133 | 88 | -34 |

| Sherbrooke | 4 | 9 | 125 | 38 | 39 | 3 | 42 | 48 | 14 |

| Thunder Bay | 1 | 0 | -100 | 0 | 0 | – | 1 | 0 | -100 |

| Toronto | 731 | 790 | 8 | 2,671 | 1,751 | -34 | 3,402 | 2,541 | -25 |

| Trois-Rivières | 1 | 2 | 100 | 14 | 0 | -100 | 15 | 2 | -87 |

| Vancouver | 429 | 280 | -35 | 2,595 | 1,169 | -55 | 3,024 | 1,449 | -52 |

| Victoria | 69 | 83 | 20 | 153 | 127 | -17 | 222 | 210 | -5 |

| Windsor | 40 | 22 | -45 | 10 | 13 | 30 | 50 | 35 | -30 |

| Winnipeg | 123 | 158 | 28 | 132 | 294 | 123 | 255 | 452 | 77 |

| Total | 2,712 | 3,156 | 16 | 9,154 | 7,859 | -14 | 11,866 | 11,015 | -7 |

Data for 2016 based on 2011 Census Definitions.

Data for 2017 based on 2016 Census Definitions.

** Belleville and Lethbridge were not metropolitan areas in 2016

## not calculable/extreme value

Source: Market Analysis Centre, CMHC